Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. “Shares outstanding” also is a line in the data that is displayed with any stock quote.

- When this takes place, a company’s outstanding shares increase, and a higher degree of liquidity results.

- This is the weighted average of the shares outstanding from the beginning date to the ending date.

- This second example of weighted average shares outstanding calculation considers the cases when shares are issued and stock dividends are given during the year.

- It accounts for the timing of share issuance or repurchase within a financial period.

- Halfway through the year, it issues new shares in the amount of an additional 100,000 shares.

Weighted Average of Outstanding Shares

This is the calculated number of days from the beginning date to the ending date. To edit a transaction, click its numbered Edit button to load the transaction into the form. Deciphering Weighted Average Shares Outstanding is akin to unlocking a deeper understanding of a company’s financial narrative. A change in WASO requires a nuanced understanding of the underlying reasons. Whether it’s expansion efforts necessitating more capital or strategic share repurchases, the implications can differ substantially. Analysts and investors are advised to delve into why WASO is changing and understand the broader strategic moves a company is making.

Weighted Average Share Outstanding Calculation Example #2

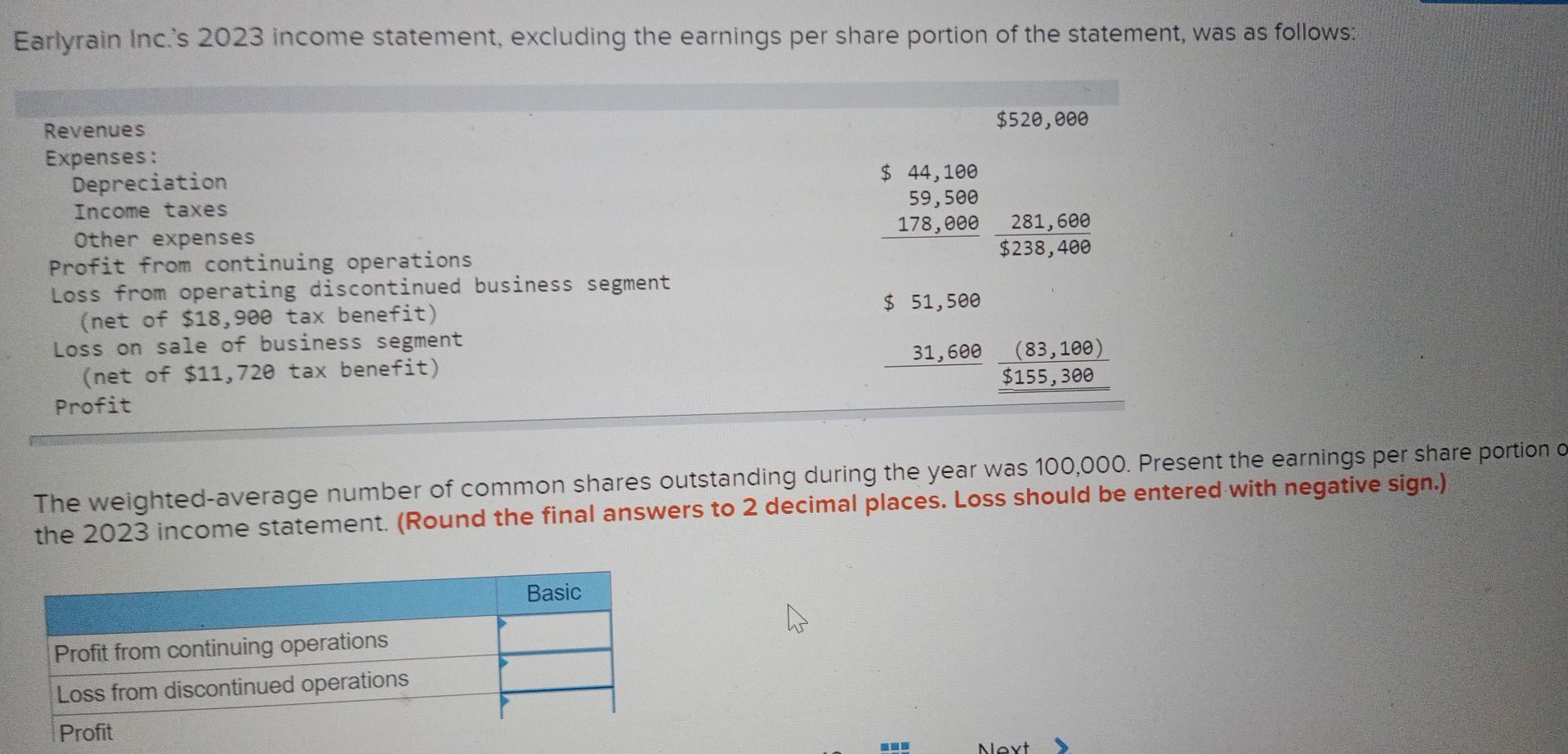

Let’s say that a company earned $100,000 this year and wants to calculate its earnings per share (EPS). At the beginning of the year, the company has 100,000 shares outstanding but issues an additional 50,000 halfway through the year, for an ending total of 150,000. Instead of computing EPS based on the ending number of shares, which would produce EPS of $0.67, a weighted average should be taken. The following are the three steps to calculate weighted average shares outstanding. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) in order to provide a fair view of a company’s financial condition. Using weighted average shares outstanding gives a more accurate picture of the impact of per-share measurements like earnings per share (EPS).

What are some examples of weighted average shares outstanding calculations?

The number of shares of a company outstanding is not constant and may change at various times throughout the year, due to a share buyback, new issues, conversion, etc. While shares outstanding account for company stock that includes restricted shares and blocks of institutional shares, floating stock specifically refers to shares that are available for trading. Floating stock is calculated by taking outstanding shares and subtracting restricted shares. Restricted stock are shares that are owned by company insiders, employees and key shareholders that are under temporary restriction, and therefore cannot be traded. For a blue chip stock, the increased number of shares outstanding due to share splits over a period of decades accounts for the steady increase in its market capitalization and concomitant growth in investor portfolios.

Shares outstanding are the stock that is held by a company’s shareholders on the open market. Along with individual shareholders, this includes restricted shares that are held by a company’s officers and institutional investors. A company’s outstanding shares decrease when there is a reverse stock split. A company generally embarks on a reverse split or share consolidation to bring its share price into the minimum range necessary to satisfy exchange listing requirements.

When divided by the 983,333 weighted average of shares outstanding, this results in $1.63 earnings per share for the year. A stock split, for example, increases the number of shares but does not change the company’s market capitalization. A company that announces a 2-1 stock split as of a certain date doubles its number of shares outstanding on that date.

The number of shares outstanding can also be reduced via a reverse stock split. The weighted average number of shares outstanding means the equivalent number of whole shares that remain outstanding during a particular period. It is computed by multiplying the number of common shares by the fraction of the period they have been outstanding.

If two or more stock transactions occurred on the same date, please combine them into a single entry. Enter the number of beginning shares outstanding and then select the beginning date in the row directly below this one. These actions can signal different strategic moves, such as a company’s confidence in its stock or efforts to consolidate ownership. The key distinction between a simple average and a weighted average lies in the consideration of time. By doing so, WASO offers a more accurate reflection of the company’s equity structure over time, crucial for financial analyses like Earnings Per Share (EPS) calculations. Therefore, the shares outstanding after that date (and retired on 1 September) are not the same as those that existed prior to that date.

This is the weighted average of the shares outstanding from the beginning date to the ending date. To add a transaction, select the date of the transaction (must be unique from all other transaction dates), select Increase or Decrease, and enter the number of shares transacted. Use this section to enter the stock transactions educator expense deduction that occurred between the beginning and ending dates selected above. Note that the calculator will attempt to sort the transactions in chronological order (from earliest to latest), but it would be best if you entered them in that order. In the next row, input the number of months for which these values held true.