Let’s say you’re trying to determine how many units of your widget you need to produce and sell to break even. If you’d prefer to calculate how many units you need to sell before breaking even, you can use the number of units in your calculation. As you can see, for the owner to have a profit of $1,200 per week or $62,400 per year, the company’s annual sales must triple.

Break-Even Analysis: Formula and Calculation

The break-even point formula can determine the BEP in product units or sales dollars. To demonstrate the combination of both a profit and the after-tax effects and subsequent calculations, let’s return to the Hicks Manufacturing example. Let’s assume that we want to calculate the target volume in units and revenue that Hicks must sell to generate an after-tax return of $24,000, assuming the same fixed costs of $18,000. However, using the contribution margin per unit is not the only way to determine a break-even point. Recall that we were able to determine a contribution margin expressed in dollars by finding the contribution margin ratio. We can apply that contribution margin ratio to the break-even analysis to determine the break-even point in dollars.

Situation 1: Comparing short-maturity bonds with long-maturity bonds

Others ask, “At what point will I be able to draw a fair salary from my company? First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300). The total variable costs will therefore be equal to the variable cost per unit of $10.00 multiplied by the number of units sold. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs.

- Since the expenses are greater than the revenues, these products great a loss—not a profit.

- If you won’t be able to reach the break-even point based on the current price, it may be an indicator that you need to increase it.

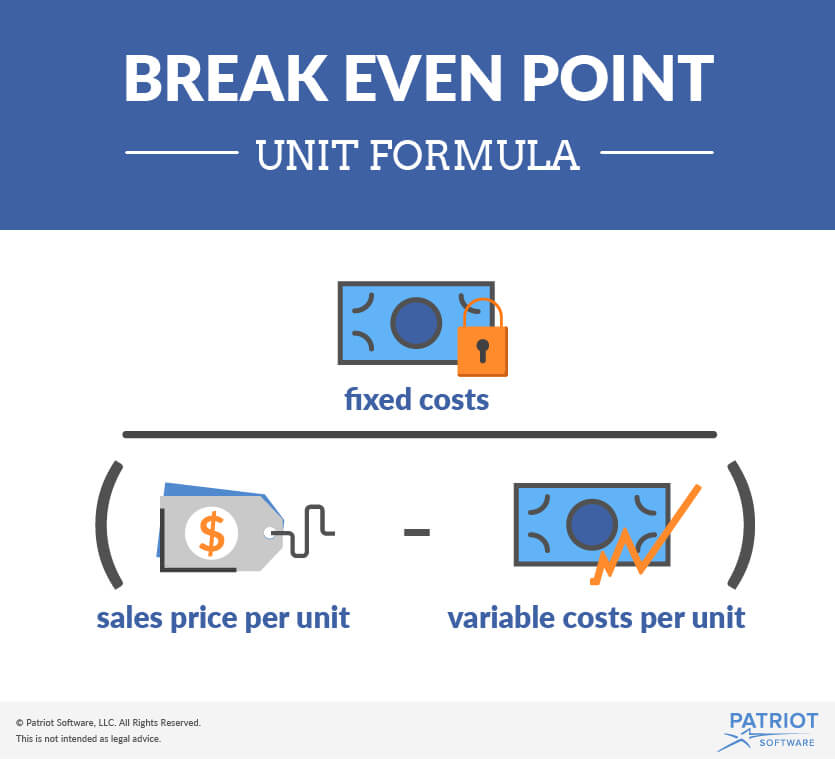

- The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit.

- At \(175\) units (\(\$17,500\) in sales), Hicks does not generate enough sales revenue to cover their fixed expenses and they suffer a loss of \(\$4,000\).

- Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even.

What Is a Breakeven Point?

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. If the price stays right at $110, they are at the BEP because they are not making or losing anything. Options can help investors who are holding a losing stock position using the option repair strategy. Hicks Manufacturing can use the information from these different scenarios to inform many of their decisions about operations, such as sales goals.

Shape Calculators

The put position’s breakeven price is $180 minus the $4 premium, or $176. If the stock is trading above that price, then the benefit of the option has not exceeded its cost. In a recent month, local flooding caused Hicks to close for several days, reducing the number of units they could ship and sell from 225 units to 175 units.

Break-even point Formula and analysis

It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation. A more advanced break-even analysis calculator would subtract out non-cash expenses from the fixed costs to compute the break-even point cash flow level. The break-even formula in sales dollars is calculated by multiplying the price of each unit by the answer from our first equation.

Since the price per unit minus the variable costs of product is the definition of the contribution margin per unit, you can simply rephrase the equation by dividing the fixed costs by the contribution margin. Let’s intro to bookkeeping and special purpose journals take a look at a few of them as well as an example of how to calculate break-even point. Simply enter your fixed and variable costs, the selling price per unit and the number of units expected to be sold.

Break-even analysis, or the comparison of sales to fixed costs, is a tool used by businesses and stock and option traders. It is essential in determining the minimum sales volume required to cover total costs and break even. Break-even analysis compares income from sales to the fixed costs of doing business. The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even.

The fixed costs are those that do not change, no matter how many units are sold. Revenue is the price for which you’re selling the product minus the variable costs, like labor and materials. One can determine the break-even point in sales dollars (instead of units) by dividing the company’s total fixed expenses by the contribution margin ratio. As you can see there are many different ways to use this concept. Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times.