Every time merchandise is bought or sold, the perpetual inventory system will update inventory levels automatically. This constant updating allows businesses to be aware of their best-selling goods and services and what inventory is running low on supply. There are key differences between perpetual inventory systems and periodic inventory systems. Perpetual inventory is computerized, using point-of-sale and enterprise asset management systems, while periodic inventory involves a physical count at various periods of time. The latter is more cost-efficient, while the former takes more time and money to execute.

Optimizing Sales on Account for Financial Stability

- This data will be useful when installing such a system inside your business.Read on for further information about perpetual inventory systems and how they can help you better manage your business.

- In a periodic system, no accounting is performed for the cost of goods sold until the end of the accounting period.

- First, the software credits the sales account and debits the accounts receivable or cash.

- Economic Order Quantity (EOQ) considers how much it costs to store the goods alongside the actual cost of the goods.

The infrastructure needed to implement this strategy accurately is substantial. Salespeople can manage expectations and deliver a better customer experience. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

How TopBuxus 10x’d Sales Volume in Just 4 Months with ShipBob [Case Study]

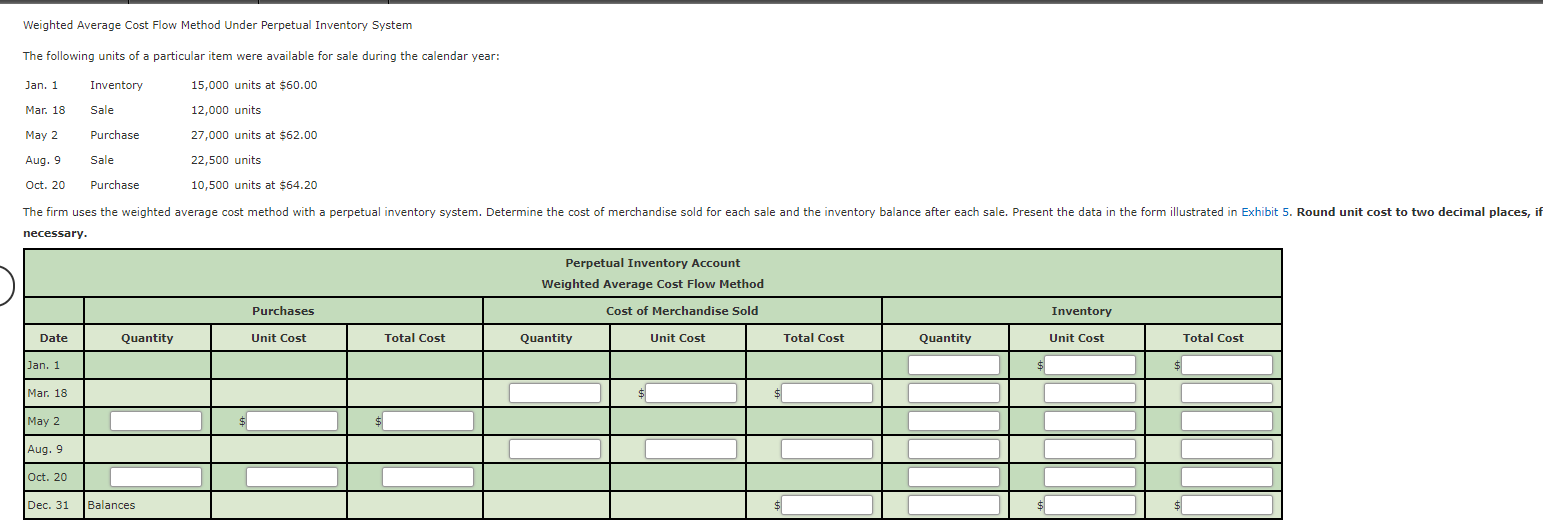

Inventory replenishments and holding expenses are managed and reduced with real-time data. Businesses value their inventory using a Weighted Average Cost (WAC) cost flow assumption. Accountants carry out this differently in a perpetual system as opposed to a periodic system.

Reorder points are adjusted to maintain optimal inventory levels

However, perpetual inventory systems require manual adjustments in the event of theft, breakage, or unrecorded transactions. By relying on digital technologies, perpetual inventory systems reduce the need to physically count a company’s inventory. One of the main differences between these two types of inventory systems involves the companies that use them. Smaller businesses and those with low sales volumes may be better off using the periodic system. In these cases, inventories are small enough that they are easy to manage using manual counts.

Inventory Valuation Methods

When all 500 widgets are scanned, the inventory count for that widget would have increased by 500 SKUs. To make it easier to understand, let’s use a hypothetical perpetual inventory system example. Below are some of the most frequently asked questions about using a perpetual inventory system. LIFO is usually used by businesses dealing with non-perishable goods or products with long shelf lives. It may be advantageous for firms going through increased expenditures to utilize LIFO, as this could permit them to report lower gains and possibly lessen their tax duties.

Transaction records

A perpetual inventory system uses point-of-sale terminals, scanners, and software to record all transactions in real-time and maintain an estimate of inventory on a continuous basis. A periodic inventory system requires counting items at various intervals, such as weekly, monthly, quarterly, or annually. The cost of goods sold (COGS) is an important accounting metric derived by adding the beginning balance of inventory to the cost of inventory purchases lost or stolen refund and subtracting the cost of the ending inventory. With a perpetual inventory system, COGS is updated constantly instead of periodically with the alternative physical inventory. A perpetual inventory system is a system used to track and record stock levels, in which every purchase and sale of stock is logged automatically and immediately. In this system, every time a transaction takes place, software records a change in inventory levels in real-time.

A perpetual inventory system has a lot of advantages for ecommerce businesses of all sizes. Not only does it help track inventory data in real-time, but it also helps eliminate labor costs and human error. Let’s look at why ecommerce businesses choose to use a perpetual inventory system. The goal of using the WAC is to give every inventory item a standard average price when you make a sale or purchase. In a perpetual system, you would not calculate the WAC using a formula for a specific period.

This assumption states that the first products placed in inventory are also the first items sold. After an accounting period, a periodic inventory system determines COGS in a lump sum following a physical inventory. Before the end of the accounting period, it is impossible to decide on an exact COGS. When using this approach, a business needs to make more effort to maintain thorough records of the products it has on hand. In this guide, we will be explaining what a perpetual inventory system is, its advantages, and whether or not it is the right inventory management practice for your small business accounting.

It is done by understanding customer behavior in the context of historical trends. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.